Home PCB Design software Electronics Prototyping Schematic Design Electronics Components

The Integration of Electronics Design and Embedded Systems in Property Insurance

Category : | Sub Category : Posted on 2023-10-30 21:24:53

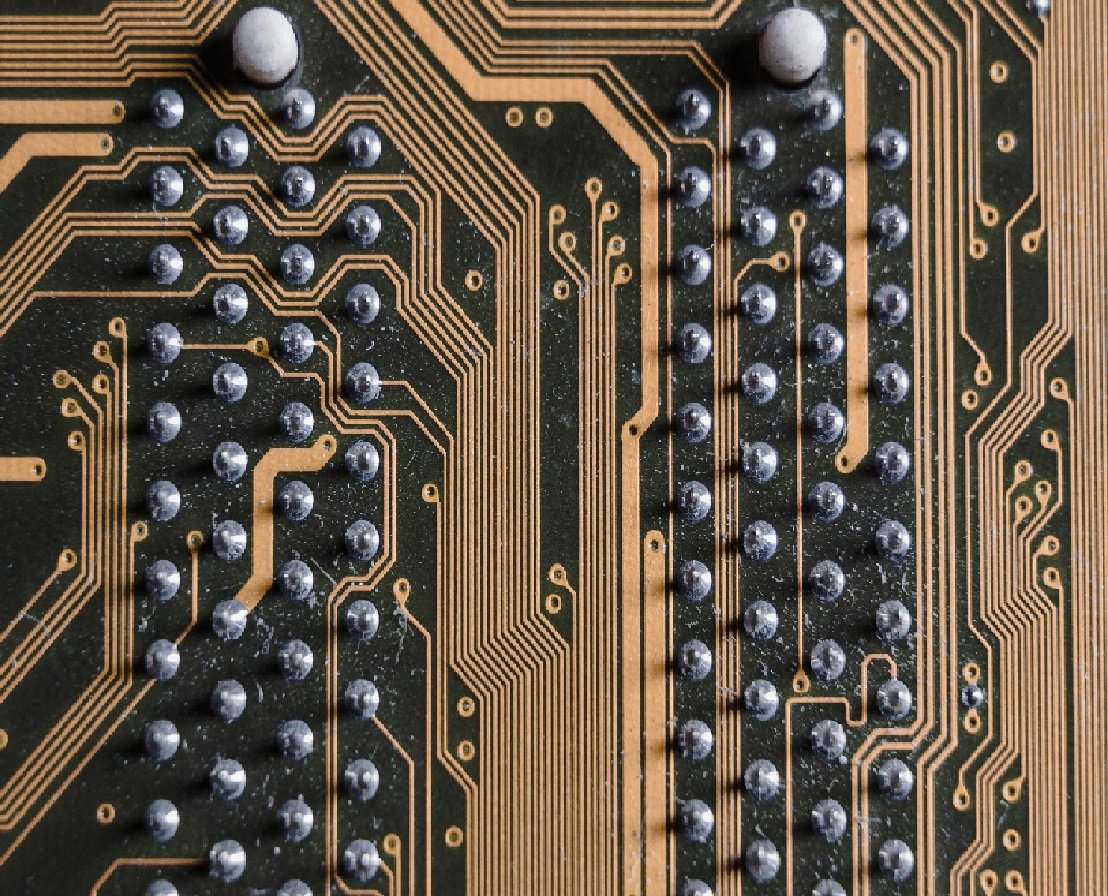

Introduction: In today's digital age, technology plays a crucial role in various industries, and property insurance is no exception. As the world becomes more interconnected, the merging of electronics design and embedded systems into property insurance has become an essential aspect of safeguarding assets against potential risks. In this blog post, we will delve into why the integration of electronics design and embedded systems is vital in property insurance and explore how this integration enhances risk management. Understanding Electronics Design and Embedded Systems: Before delving into their application in property insurance, it is important to understand the concepts of electronics design and embedded systems. Electronics design involves the creation, development, and optimization of electronic devices and systems. On the other hand, embedded systems refer to computer systems integrated into everyday objects or systems to perform specific tasks. These embedded systems are designed to interact with various sensors, actuators, and other components to collect and process data. The Importance of Integrating Electronics Design and Embedded Systems in Property Insurance: 1. Enhanced Risk Assessment: By leveraging electronics design and embedded systems, property insurance companies can enhance their risk assessment capabilities. These technologies allow for the creation of smart sensors that can detect potential hazards, such as fire, water leaks, or break-ins, in real-time. By continuously monitoring these risks, insurance providers can offer tailored coverage and adjust premiums accordingly. 2. Real-time Monitoring and Reporting: Integrating electronics design and embedded systems into property insurance enables real-time monitoring and reporting of property conditions. Embedded systems can gather data about temperature, humidity, occupancy, and other environmental factors, providing insurers with accurate and up-to-date information. This data allows insurers to proactively identify potential risks and take preventive measures, reducing the likelihood of claims. 3. Prompt Incident Response: In the event of an incident, such as a fire or theft, embedded systems equipped with electronics design components can provide instant notifications to property owners and insurance companies. These systems can also trigger immediate responses, such as activating security measures or notifying emergency services. By quickly responding to incidents, insurers can minimize property damage and speed up the claims process. 4. Personalized Insurance Premiums: Traditionally, property insurance premiums were based on generic risk factors. However, with the integration of electronics design and embedded systems, insurers can personalize premiums based on individual property characteristics and real-time data. This allows for fairer and more accurate pricing, benefiting both insurance companies and policyholders. 5. Long-term Cost Savings: Although the initial cost of implementing electronics design and embedded systems may seem significant, the long-term benefits outweigh the investment. By preventing or minimizing potential risks, insurers can significantly reduce the overall number and value of claims. Additionally, the ability to remotely monitor and manage properties can streamline operations, resulting in cost savings for insurance providers. Conclusion: The integration of electronics design and embedded systems in property insurance opens up new possibilities for risk management and mitigation. As technology continues to advance, insurers are leveraging electronics design to create smart sensors and embedded systems that enhance risk assessment, enable real-time monitoring and reporting, and facilitate prompt incident response. By personalizing insurance premiums and optimizing risk assessment, these integrations benefit both insurance companies and policyholders, leading to more accurate coverage and fair pricing. Embracing this integration ensures the future of property insurance is technologically advanced and customer-centric. Seeking answers? You might find them in http://www.insuranceintegration.com

Leave a Comment:

SEARCH

Recent News

- Vancouver is rapidly becoming a hub for innovative startups in the fields of GPU technology, artificial intelligence (AI), and electronics. These industries are thriving in the city, attracting entrepreneurs, investors, and talent from around the world. In this blog post, we will introduce some of the top startups in Vancouver that are making a significant impact in these sectors.

- **The Role of GPUs in Advancing AI Electronics in Vancouver's Import-Export Industry**

- Vancouver has emerged as a thriving hub for the electronics industry, especially in the realm of GPU and AI technologies. Companies in Vancouver are leading the way in developing cutting-edge solutions that leverage the power of GPUs and AI to drive innovation across various sectors.

- Vancouver is home to a thriving tech scene, with several companies leading the way in GPU, AI, and electronics innovation. In this article, we will take a look at some of the best companies in Vancouver that are at the forefront of these technologies.

- The UK government has been at the forefront of supporting businesses in various sectors, including electronics and AI, through a range of support programs. One key area where this support is particularly evident is in the development of GPU technology.

- In today's fast-paced technological landscape, the intersection of GPUs, AI, and electronics has revolutionized various industries. Ireland, known for its vibrant tech scene, is home to several top companies at the forefront of this cutting-edge integration. Let's take a closer look at some of the top Irish companies making significant strides in the GPU, AI, and electronics space.

- Tokyo is a hub for top companies in the fields of GPU, AI, and electronics. These companies play a significant role in driving innovation and technological advancements in various industries. Let's take a closer look at some of the top companies in Tokyo in these sectors.

- Tokyo is known for its vibrant startup scene, with numerous companies emerging in various industries, including GPU, AI, and electronics. In recent years, these three sectors have seen a surge in innovation and growth, driven by the increasing demand for advanced technology solutions.

READ MORE

3 months ago Category :

Vancouver is rapidly becoming a hub for innovative startups in the fields of GPU technology, artificial intelligence (AI), and electronics. These industries are thriving in the city, attracting entrepreneurs, investors, and talent from around the world. In this blog post, we will introduce some of the top startups in Vancouver that are making a significant impact in these sectors.

Read More →3 months ago Category :

**The Role of GPUs in Advancing AI Electronics in Vancouver's Import-Export Industry**

Read More →3 months ago Category :

Vancouver has emerged as a thriving hub for the electronics industry, especially in the realm of GPU and AI technologies. Companies in Vancouver are leading the way in developing cutting-edge solutions that leverage the power of GPUs and AI to drive innovation across various sectors.

Read More →3 months ago Category :